Common Investment Risks: Identifying and Managing Them

Understanding Investment Risk: What It Really Means

Investment risk refers to the potential for losing some or all of your investment. It’s important to understand that every investment comes with a certain level of risk, whether it’s stocks, bonds, or real estate. The key is to identify the risks associated with each type of investment to make informed decisions.

In investing, what is comfortable is rarely profitable.

For instance, stocks tend to have higher volatility compared to bonds, which are generally seen as safer. This means that while stocks can offer higher returns, they can also lead to significant losses in a short period. Understanding this trade-off is crucial for any investor looking to build a balanced portfolio.

Related Resource

By recognizing the different types of investment risks, you can tailor your strategy to align with your financial goals and risk tolerance. This foundational knowledge sets the stage for managing risks effectively.

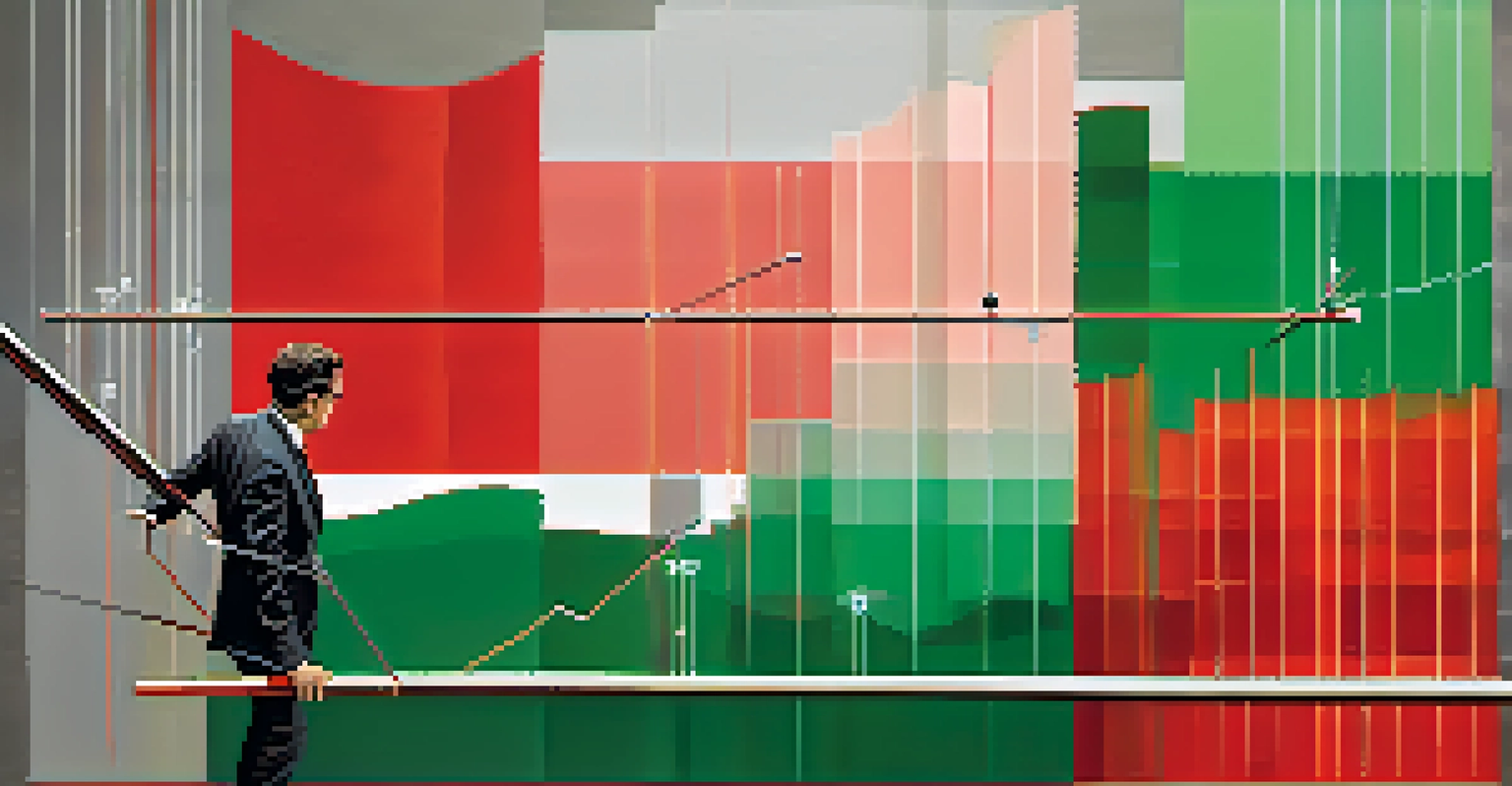

Market Risk: Navigating the Ups and Downs

Market risk, also known as systematic risk, arises from broader market factors that can affect all investments. Economic downturns, political instability, or global events like pandemics can cause market-wide fluctuations. This type of risk is unavoidable, but understanding it can help you prepare for potential downturns.

For example, during a recession, most stock prices tend to decline, regardless of the company’s individual performance. Diversifying your investments, such as including bonds or international stocks, can help mitigate this risk. By spreading your investments across various asset classes, you can cushion the impact of market downturns.

Investment Risk is Inevitable

Every investment carries a certain level of risk, making it crucial for investors to understand and manage these risks to make informed decisions.

While you can’t eliminate market risk, you can manage it through strategic asset allocation and staying informed about market trends. This proactive approach will help you navigate the uncertainties of investing.

Credit Risk: Understanding Borrower Reliability

Credit risk refers to the possibility that a borrower may default on their loan obligations. This risk is particularly relevant for bond investors, as the issuer’s ability to repay can significantly affect the bond's value. Understanding the creditworthiness of issuers is vital in assessing potential risks.

Risk comes from not knowing what you're doing.

For instance, investing in government bonds is often viewed as safer due to the lower likelihood of default compared to corporate bonds. However, high-yield corporate bonds might offer higher returns at the cost of increased credit risk. Researching the financial health of issuers and their credit ratings can help you make informed choices.

Related Resource

To manage credit risk effectively, consider diversifying your bond portfolio and including assets with varying credit ratings. This strategy can help reduce the impact of any single issuer's default on your overall investment.

Liquidity Risk: The Challenge of Quick Access

Liquidity risk is the danger of not being able to sell an investment quickly without a significant loss in value. This situation often arises with real estate or certain collectibles, which may take time to sell. Understanding liquidity is crucial, especially if you anticipate needing quick access to your funds.

For example, while a stock can typically be sold in seconds during market hours, a property might linger on the market for months. Investing in more liquid assets can help ensure that you can access your money when you need it. Additionally, keeping a portion of your portfolio in cash or cash-equivalents can provide a safety net.

Diversification Mitigates Risks

Spreading investments across various asset classes can cushion the impact of market downturns and enhance overall portfolio stability.

By balancing your portfolio with both liquid and illiquid investments, you can manage liquidity risk while still pursuing higher returns. This strategic approach ensures you’re prepared for unexpected financial needs.

Inflation Risk: Protecting Your Purchasing Power

Inflation risk involves the potential for rising prices to erode the purchasing power of your investments over time. If the return on your investment doesn’t keep pace with inflation, your money may buy less in the future. Understanding this risk is essential for long-term financial planning.

For instance, if you invest solely in cash savings, inflation can diminish the value of your savings over time. Equities and real estate often provide a hedge against inflation because they have the potential for higher returns. By including assets that historically outpace inflation, you can safeguard your purchasing power.

Related Resource

To effectively manage inflation risk, consider a diversified portfolio that includes growth-oriented investments. This strategy helps ensure your investments not only keep pace with inflation but also grow your wealth over time.

Interest Rate Risk: The Impact on Fixed Income Investments

Interest rate risk is the potential for investment values to decline due to changing interest rates. This risk primarily affects fixed-income securities like bonds. When interest rates rise, existing bonds with lower rates may lose value, impacting your overall portfolio.

For instance, if you hold a bond yielding 3% and interest rates rise to 5%, new bonds become more attractive, causing your bond's market value to drop. Understanding the relationship between interest rates and bond prices is key to managing this risk. Consider laddering your bond investments to mitigate interest rate risk effectively.

Stay Informed to Manage Risks

Regularly reviewing market trends and economic indicators helps investors anticipate potential risks and adjust their strategies accordingly.

By diversifying across various maturities and types of bonds, you can soften the impact of interest rate fluctuations. This proactive approach allows you to navigate the complexities of fixed-income investing.

Geopolitical Risk: The Influence of Global Events

Geopolitical risk refers to the uncertainty that arises from political events or instability in different regions. Events such as elections, wars, or trade disputes can significantly impact markets and investments. Understanding these risks is essential for global investors.

For example, a political crisis in a country might disrupt supply chains, affecting companies globally. Investors should stay informed about geopolitical developments and consider how they might influence their investments. Diversifying your portfolio geographically can also help manage this risk.

By keeping an eye on global events and adjusting your investment strategy accordingly, you can better navigate the uncertainties posed by geopolitical risks. This awareness can help you make informed decisions that align with your investment goals.

Effective Strategies for Managing Investment Risks

Managing investment risks requires a proactive approach and a well-thought-out strategy. Diversification is one of the most effective ways to spread risks across various assets, reducing the impact of any single investment's poor performance. A balanced portfolio can help you weather market fluctuations.

Additionally, regularly reviewing and rebalancing your portfolio ensures that your investments align with your goals and risk tolerance. Staying informed about market trends and economic indicators can also help you anticipate potential risks and adjust your strategy accordingly. This vigilance is key to successful investing.

Finally, consider consulting with a financial advisor who can provide personalized guidance tailored to your unique situation. By implementing these strategies, you can take control of your investment risks and work towards achieving your financial objectives.